Every Company Will Be a Fintech Company... But Why Are They Not (Still)?

The hard things about building embedded fintech products

Embedded fintech has emerged as a significant opportunity in recent years. It’s far more than just a buzzword; you can find remarkable examples worldwide, such as Ant Financial, Shopify, Mercado Pago, Booking.com, and iFood Pago, all of which are delivering customized financial services and achieving impressive results. One of the most well-known quotes in this field (perhaps the most famous) is Angela Strange’s “Every Company Will Be a Fintech Company” from her insightful presentation at the 2019 a16z Summit.

But why hasn’t this become a reality for more companies? If the thesis holds true, shouldn’t we see a broader adoption? Why are some major sectors, like healthcare and others, still not capitalizing on this massive opportunity? Let’s try to understand…

First of all, what is a good definition of embedded fintech? I really like this part from the report Embedded Fintech: What is it? (Part I) by Medha Agarwal and Emily Man:

“By integrating financial products tailored to the needs of specific sets of users within platforms where they already are, it’s possible to offer tailored suites of products magically, at the point of need, with zero friction to adopt.”

This definition offers an intriguing perspective: it’s not just about partnering with banks to offer their products through your channels and earn a commission. It goes beyond that. It’s about deeply understanding your core customers and stakeholders, identifying their problems, and providing them with better solutions that align with your value proposition. Although we’ve seen significant advancements in Banking as a Service (BaaS), payment infrastructure, and proactive regulation from Central Banks like Brazil’s, which have made the development of financial products easier, why does so much still remain to be done?

IT´S NOT EASY!

First of all, it’s not that simple. I’ve compiled over 80 questions that need to be answered and mastered in order to build a payment solution. To emphasize this complexity, let’s consider just a few questions related to legal, risk and fraud responsibilities:

Who is responsible for client approval: the payment provider or the company offering the product?

What is a chargeback, and how does it work?

What is the dispute process, and how does it work?

Should I use anti-fraud solutions? If so, which ones are recommended?

Do I need to legally change my company’s main activity?

What are the tax implications?

Do I need to update my terms of use?

Do I need to become a sub-acquirer?

What is the best business model, and what are all the legal obligations?

Am I subject to regulation by the Central Bank?

This might seem obvious if you come from the financial services industry, but these companies have other core businesses. As a result, many of these questions are entirely new to them, and leadership is likely encountering them for the first time. And the list goes on... You have pricing considerations, technical challenges, product development issues, distribution strategies and more.

Now, imagine you also want to offer banking, credit, and insurance services. That would add another extensive set of complexities to understand. I believe that bringing in top talent is the most effective way to accelerate the company’s learning and execution curve. However, the key takeaway is that there is a challenging journey between the initial concept, leveraging available APIs, and delivering a successful product.

SAME COMPANY, DIFFERENT METRICS

Another challenge is understanding the metrics and KPIs specific to financial services. Managing your business in this context is a whole new world. If you're a SaaS founder or leader, you’re probably used to metrics like MRR, ARR, subscriptions, ARPA, and so on. Or maybe you run a marketplace? In fintech, the way you analyze the business and make decisions is different. This new set of metrics can lead to a cultural shock, as your data mindset is completely different. The way investors, product team, and other key stakeholders evaluate your results will change, and you’ll need to educate them on this new approach.

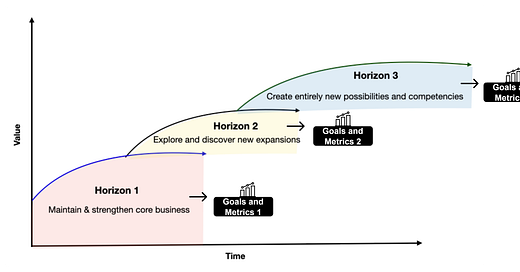

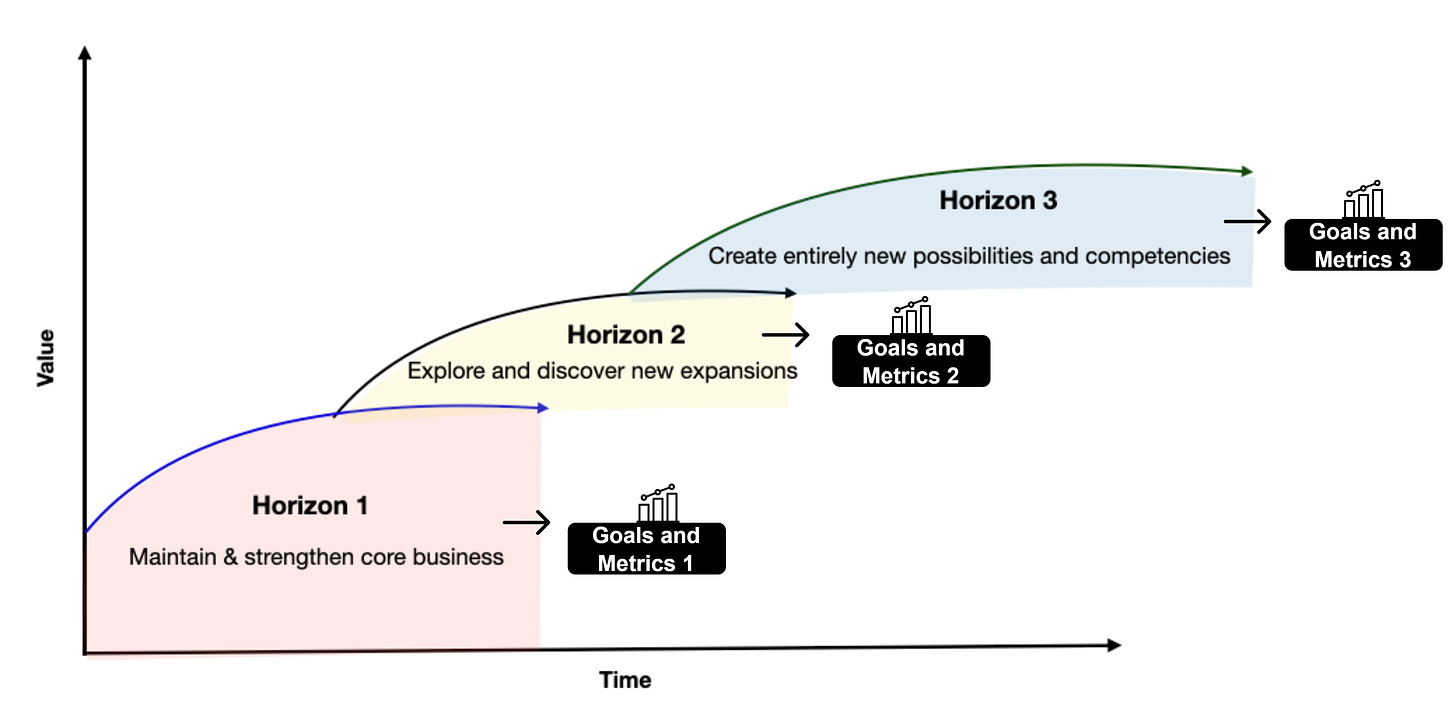

If you use McKinsey’s Three Horizons Model as a framework for managing both your core business and innovation, balancing short- and long-term goals, your expectations need to shift. You shouldn’t expect a new fintech product to grow at the same rate as your core product. The products are different, as are their stages of development, and recognizing this distinction is crucial.

Perhaps the model has some shortcomings when it comes to today's time horizons, as Steven Blank aptly explains in his article McKinsey’s Three Horizons Model Defined Innovation for Years. Here’s Why It No Longer Applies. However, the importance of using the right metrics remains relevant.

And why all of this is important to building a great embbeded fintech product? According to a Harvard Business Review´s article “Boost Your Team’s Data Literacy”, most of us are not not very good at interpreting and making sense of data. So if this is true with the right metrics, how does it work in the confusing enviroment of which metrics shall we use?

TIMING AND FOCUS

Yes, everyone wants the new revenue streams that financial services can bring, especially after seeing the impressive quarterly results from Mercado Pago. But how much of a priority is fintech going to be? And when is the right time to introduce a financial offering? You still want your core business to grow, your market share to expand... and now you’re adding fintech into the mix?

This often leads to significant misalignment. Budgets might be tight, but more critically, your focus could become split. There’s a well-known Brazilian saying: if you have too many priorities, you really have no priority at all.

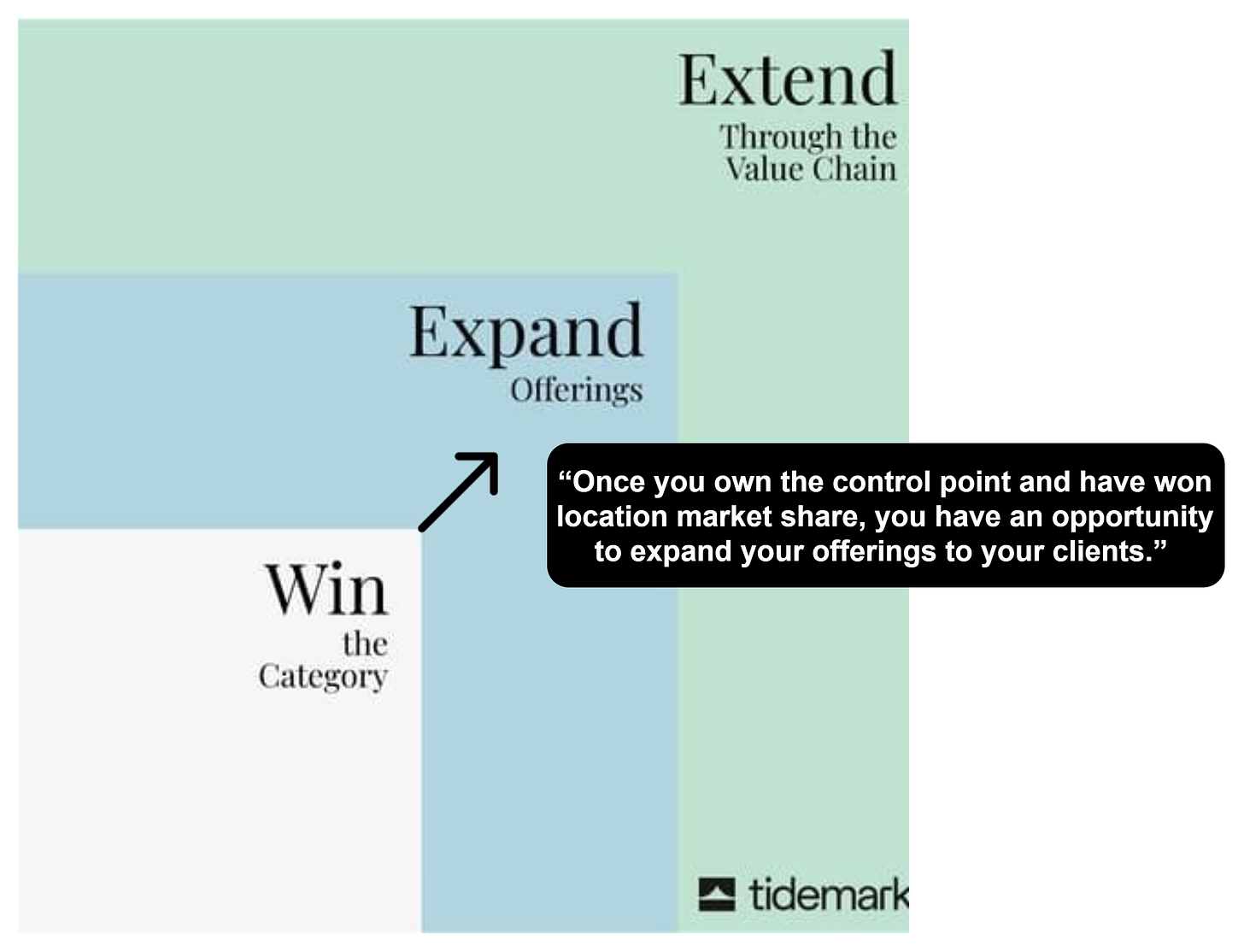

On a more technical note, I’m a fan of Tidemark’s approach in their Vertical SaaS Knowledge Project. Even if you’re not in SaaS, their playbook offers valuable insights that could be helpful.

It’s incredibly powerful to first secure the control point. With control, you gain access to data and distribution, which are crucial enablers of the fintech opportunities ahead.

You don’t want to offer financial services the same way banks do—you can likely do it better because you have access to a vast amounts of data, which is the foundation for creating customized financial products. For example, if you're a healthcare SaaS company that knows hospitals' future cash flow and can predict future insurance receivables—information that banks don’t have—who has the best opportunity to offer a credit product? But to achieve this, you need data first, and to acquire that data, you need to dominate your category (or at least, it will be very helpful).

Distribution is another critical factor. Having the best channel to offer a financial product is a key lever for success. Banks have partnered with other companies to try to succeed in specific channels. So, once you have a strong presence in a particular segment—especially with products that have higher frequency—you’re in touch with your customers far more often than anyone else. This gives you a deeper understanding of how best to approach them.

Timing is critical for a startup, and the same applies to building your embedded fintech solution. While there’s often natural excitement about the possibilities, maintaining laser-sharp focus is essential.

FURTHER TOPICS TO COME…

If you want to enter the fintech space, you need to be prepared to take risks. Financial services aren’t a completely safe haven where you can experiment without taking on responsibilities. I’ve seen many companies attempt to dive into financial services assuming the risk always falls on the BaaS or payment provider. But that’s not how it works! I highly recommend looking into PayPal’s early days, where fraud almost broke the company multiple times. Yet, these challenges ultimately made them stronger as they learned and developed robust security solutions.

Finally, the most important point: value proposition. Whether it’s a B2B or B2C product, customers don’t want just another financial product. They’re looking for something specific that solves their problems and provides a unique experience. So, if you’re only focused on increasing ARPU, you’ll likely fail to create something your customers truly need to improve their businesses, lives, or even fulfill their dreams.

Risk and value proposition will be explored in more detail soon.

GOOD NEWS

Yes, there are risks, timing issues, focus requirements, new metrics, and complexity involved. However, the purpose of this text is not to create obstacles but to address the challenges of building embedded financial services.

As Ray Dalio famously said, "Sincerely believe that you might not know the best possible path and recognize that your ability to deal well with 'not knowing' is more important.” We aimed to highlight these challenges so you can better navigate them. We hope you find this information helpful!

On a positive note, now is an excellent time to develop financial products. There are strong providers such as Zoop in Latam on which you can build your solutions, a wealth of talent available from both fintech and traditional banks (a mix of both is often ideal, in my opinion), second time entrepreneurs and significant opportunities for companies to create something remarkable, as illustrated by those mentioned at the beginning.

It's pretty exciting to witness what is about to come!

References:

Angela Strange: Every Company Will Be a Fintech Company

Medha Agarwal: Embedded Fintech: What is it? (Part I)

Steven Blank: McKinsey’s Three Horizons Model Defined Innovation for Years. Here’s Why It No Longer Applies

Josh and Marc Zao-Sanders: Boost Your Team’s Data Literacy

David Yuan: The Vertical SaaS Knowledge Project