Why You Should Be Optimistic About Fintech in Healthcare - Part II

It Starts With The Why... Why Embedded Finance?

Source: anahp, Banco Central do Brasil

Recently, embedded finance has emerged as a significant trend, powered by compelling arguments and enthusiasm. Healthcare is consistently quoted as one of the most promising sectors to explore. But what exactly is embedded finance?

“Embedded finance is the placing of a financial product in a non-financial customer experience, journey, or platform". (Source: Mckinsey)

To provide some context, the timing os this trend is particularly unique. In the past, developing financial products was a complex, costly and time-consuming endeavor. Regulation, compliance and unfriendly tech infrastructure were big challenges (part of it, still is). However, these obstacles have been overcome, or at least, eased, by API solutions created by fintechs. Today, you can integrate several solutions that facilitate the development of your own fintech, be it a payment, credit, banking or other financial solutions. The recent USD 1 billion exit of Brazilian Pismo serves as a validation of this scenario, alongside the substantial flow of venture capital funding several solutions in this space over the last years.

Now, why financial services for healthcare and why does fintech make sense here? These critical questions will be addressed in Part II of the series "Why You Should Be Optimistic About Fintech in Healthcare”. If you missed Part I, you can catch up by following this link. Once again, I hope you enjoy the ride!

Why?

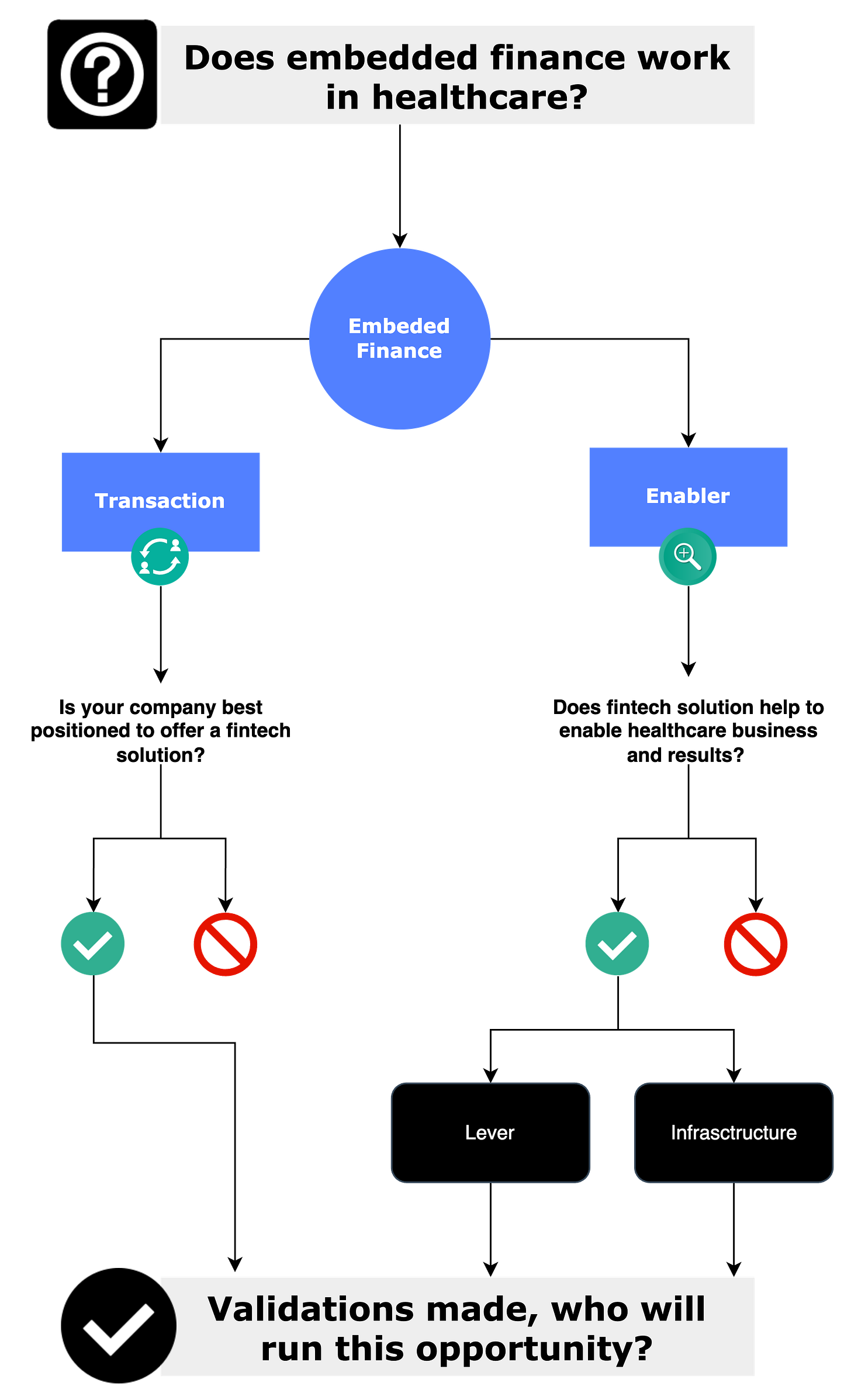

To kickstart our engines, I'd like to draw from Mike Packer's (QED Investors) perspective on embedded finance (I highly recommend the Mckinsey on Startups podcast episode "Operator's manual: QED's approach to investing in fintech). Packer presents 2 compelling angles on this topic and I couldn't agree more. These angles will also help us answer the “whys”.

1 - When you have a transaction which you are best positioned to offer a fintech solution.

A prime example is Mercado Pago, which possesses deep insights on seller data and transactions in Mercado Livre. With this understanding, they can provide customized credit solutions tailored to their client's needs, as opposed to standardized solutions typically offered by banks to small and medium-sized businesses. Often, these sellers are denied access to credit due to a lack of understanding or misinterpretation of their financial behavior.

In healthcare, consider the use case of Medicinae. By analyzing the receivables behavior of providers, alongside with payors’ track record and future receivables data, we could create a credit product to offer upfront payment solutions.

2 - When it serves as a real enabler of the business.

Alibaba, for instance, created Alipay (Ant Group) to ensure secure e-commerce payments, instilling confidence in both buyers and sellers. This solution significantly boosted sales and the e-commerce market in China, as consumers and sellers were initially worried about how e-commerce worked at the time and needed a secure environment to enjoy a positive experience.

Access to care is a relevant problem in Brazil, with many struggling to afford surgeries and treatments. Simultaneously, hospitals, doctors and providers have less demand (maybe not all of them, but it is an issue). Customized funding solution such as Dr Cash, Vidia, Flip Saude or Capim now allow patients to pay for services over up to 24 months, with monthly installments that align with their budgets. This benefits patients with care access and provides an additional revenue resource for providers.

These 2 examples of innovative solutions, such as credit for providers and patient funding, already underway in healthcare, are shining. However, we are still in the early stages. Is there a vast untapped opportunity ahead to solve problems with an outsider approach as fintech? Let's dive deeper and explore the fundamentals.

Healthcare Core Activity

What lies at the heart of healthcare? I would group medical appointment, nutrition consulting, surgeries, exams, dental treatments and other similar services under the umbrella term “care”. Care can be considered as the main activity in healthcare, right? Can we also view care as a transaction too? Let's validate this perspective with the definition of care and transaction.

"Care is the provision of what is necessary for the health, welfare, maintenance, and protection of someone or something". (Source: Oxford)

"Transaction is an occasion when someone buys or sells something, or when money is exchanged or the activity of buying or selling something.” (Source: Oxford)

Someone pays for care, whether it is patients, healthcare insurance (most part of it via corporate benefits) or the government. Sometimes these payments are combined such as co payment and public-private partnerships. Therefore, we can reasonably assume that care is indeed also a transaction.

Transaction

There is a massive financial flow in care transactions, and who better understands this than the stakeholders within the healthcare sector, including startups and established players? They possess a significant competitive advantage in terms of data, identifying pain points, and enhancing the customer experience, leading to unique financial solutions. Perhaps this may sound somewhat subjective, but the reality is healthcare is unique, and understanding the nuances is essential.

Consider a specific example: "Glosa”, as a distinctive aspect of healthcare insurance. Similar to chargebacks in credit card payments but with specific nuances, it involves disputes over medical billing by insurance payors and providers. Consequently, providers have receivables that are uncertain about receiving. How can they manage their cash flow effectively in such a scenario? Moreover, how can banks, factorings and fintechs offer basic solutions such as upfront payment? Who understand this crazy glosa dynamics? Definitely not traditional banks!

In summary, in the context of this first angle of embedded finance, there exists a transactional aspect that positions healthcare stakeholders uniquely to offer financial products. If these solutions contribute to improving the sector, they can address critical issues through innovation. This perspective is powerful, as it presents a value proposition that extends beyond mere profit-making opportunities, although profitability remains achievable and opens up new avenues for monetization. For instance, Mercado Pago represents a significant portion (46% , Source: InfoMoney) of Mercado Livre income, while Toast, a successful SaaS for restaurants in the US, 82% by the time of its IPO's S-1 (Source: TechCrunch).

Enabler

Now, let's step outside the healthcare sector briefly before returning to it. Consider a product everyone is familiar with: housing loans. The key point here is that you are not merely acquiring a financial product, you are purchasing a home. By facilitating increased purchasing power, as most people lack the full amount to buy a home outright, housing loans enable the real estate market, correct?

So how can we similarly enable business with healthcare through fintech solutions? I would bring two perspectives: the lever approach and the infrastructure perspective.

1 - Lever

Patient funding, once again, serves as a potent solution that acts as a lever to boost demand for healthcare providers. It addresses a significant pain point in terms of patient access to care. Consequently, it enhances the core function of a provider: delivering care to patients.

A lever can be defined as a solution that directly impacts a business's core activity.

2 - Infra Structure

Medical billing is undoubtedly not a core activity either for providers or payors. So, why handle it in-house with a large team and numerous manual processes, when revenue cycle startups such as Intuitive Care and Kuri offer services to do the job more effectively, thereby improving financial results. On the payor side, fraud prevention/detection is similarly non-core for healthcare insurance companies. But… it reduces costs, operational burden and significantly impacts the company's financial health. Services like Arvo and Carefy can serve the infrastructure needed to address these relevant issues.

Infrastructure is a solution that unbundles non-core activities, yet significantly impacts business results.

Now, we can confirm this perspective of an “enabler”. Therefore, both angles in which embedded finance is perceived as a significant opportunity apply to healthcare. Startups and established players are already active in this space. However, when compared to other markets, there doesn't appear to be a dominant player. So, the question arises: Who will seize this opportunity? Or is it an opportunity that will produce several winners?"

It's pretty exciting to witness what is about to come!

References:

Mckinsey Embedded finance: Who will lead the next payments revolution?: https://www.mckinsey.com/industries/financial-services/our-insights/embedded-finance-who-will-lead-the-next-payments-revolution

Operator's mannual: QED’s approach to investing in fintech: